LinkedIn, the adult version of Facebook, went public this week and its IPO was boffo, as the Weekend Wall Street Journal summarized:

LinkedIn’s shares more than doubled in their first day of trading, setting the stage for debuts from other Internet companies such as Facebook and Groupon. The outsize demand for the stock of an Internet company that is growing rapidly but had a profit of $15.4 million last year is the latest sign of the surge—some say bubble—in Web valuations. By Thursday’s 4 p.m. close, the stock had soared 109% to $94.25. At day’s end, LinkedIn was valued at $8.9 billion.

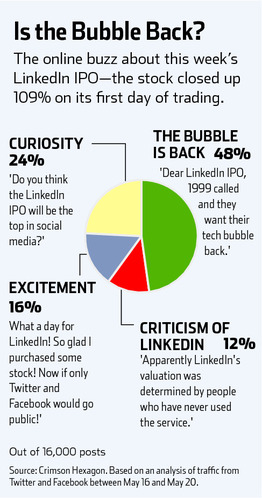

That slingstock was totally buzzworthy, as the Journal helpfully charted:

Nowhere in the analysis, however, was the category Criticism of Morgan Stanley and Bank of America’s Merrill Lynch Division. Those two outfits managed LinkedIn’s IPO, and, according to new (and sharp) New York Times op-ed columnist Joe Nocera, they scammed LinkedIn, which received $45 per share in the initial public offering.

When LinkedIn’s shares started trading on the New York Stock Exchange, they opened not at $45, or anywhere near it. The opening price was $83 a share, some 84 percent higher than the I.P.O. price. By the time the clock had struck noon, the stock had vaulted to more than $120 a share, before settling down to $94.25 at the market’s close. The first-day gain was close to 110 percent.

I have no doubt that most everyone at LinkedIn was thrilled to see the run-up; most executives at start-ups usually are. An I.P.O. is an important marker for any company. And, of course, the executives themselves are suddenly rich. But, in reality, LinkedIn was scammed by its bankers.

Nocera’s reasoning:

The fact that the stock more than doubled on its first day of trading — something the investment bankers, with their fingers on the pulse of the market, absolutely must have known would happen — means that hundreds of millions of additional dollars that should have gone to LinkedIn wound up in the hands of investors that Morgan Stanley and Merrill Lynch wanted to do favors for. Most of those investors, I guarantee, sold the stock during the morning run-up. It’s the easiest money you can make on Wall Street.

And the hardest lesson an IPO can teach.

Hey, no one is forcing anyone to buy the stock, at any price. So either you are buying in the hopes of flipping (there’s a “greater fool” out there, is the theory)–and may lose out; or you geuinely believe it’s worth that much. Either way, no one is forcing you.

Isn’t that what a bubble is all about?

Yeah, if you’re inside the bubble, not on it.