The other day the hardworking staff received this email from Boston’s Museum of Fine Arts.

Not to get technical about it, but we don’t have a digital collection of NFTs, mostly because they’re the pet rocks of the art world.

But we’re getting ahead of ourselves.

Last year the Boston Globe’s Malcolm Gay reported on the origins of the MFA’s NFT fling.

‘Someone had to move first’: MFA plans sale of NFTs based on fragile French pastels

The museum hopes to fund conservation efforts with the proceeds, but uncertainty in the crypto market raises questions.

How much would you pay for a rarely seen artwork by French Impressionist Claude Monet?

The Museum of Fine Arts aims to find out — sort of — when it dips its toe in the choppy waters of cryptocurrency next month, selling a collection of non-fungible tokens based on pastels from its collection by Monet, Edgar Degas, and other Impressionist luminaries.

The sale, which is being orchestrated by the French startup LaCollection, positions the MFA as one of the first encyclopedic museums in the United States to embrace the novel technology — which links digital artworks to online ownership certificates stored on the blockchain.

Free Degas NFTs or not, the jury is decidedly out on whether vapor-art has been croaked by the crypto crash, as a simple Google search will reveal.

It is, shall we say, a (Bit)coin flip. But the Irish in us leans toward Terry Sullivan’s analysis last November at Yahoo.

In mid-October, Bloomberg published a massive 40,000-word story in Businessweek, written by finance writer, Matt Levine, who attempted to demystify and explain cryptocurrency as well as NFTs. But one might say that both crypto and NFTs got quite a harsh critique in Levine’s story: For example, in the middle of the article, Levine refers to an Esquire article, which discusses how some in crypto are trying to reimagine books as investment opportunities! Levine’s take is this? “The bad way to put this is that every web3 project is simultaneously a Ponzi.”

Levine also questions the thin connection between the code you’re investing in on the blockchain when you buy an NFT and the actual piece of art. He writes, “but what does it mean to say that the NFT is a piece of digital art? The art does not live on the blockchain…. If you buy an NFT, what you own is a notation on the blockchain that says you own a pointer to some web server.” It’s like paying a museum for a Cezanne, and they only give you the page from the museum catalog…or better yet, they’ve only sent you the museum wall label!

Beyond the financials, though, there’s also the fallout for the prestige of fine art, as Bendor Grosvenor noted in his Diary of an art historian blog last year (via The Art Newspaper).

The British Museum demeans itself by selling its works as NFTs—and will probably live to regret it

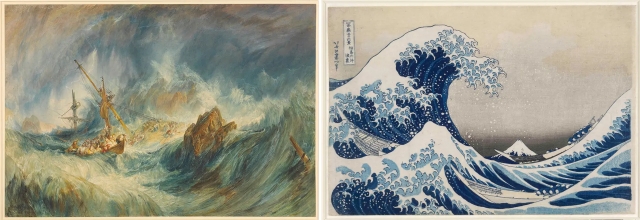

In giving cultural validity to meaningless reproductions of Turner and Hokusai pieces, The British Museum blurs the lines between real and fake at its peril

According to an early biographer, J.M.W. Turner viewed publishers who sold his prints as greedy middle men, “huxters of art”. We can easily imagine what he’d make of museums selling his work as NFTs, as the British Museum will this month through the website La Collection. Twenty watercolours will be sold, with prices for the “rarest” starting at €4,999 ($5,660). The iniative follows on from the sale of 200 Hokusai works from the museum’s collection as NFTs last year.

That sum gets you a jpeg with no rights, physical or intellectual, on the original image. What you’re really buying is the sequence of code entered onto the blockchain, which is unique and thus tradable. If enough people believe the line of code is worth something then you can sell your Turner jpeg for a profit. Think of it as the emperor’s new code.

We’re guessing the MFA doesn’t care a whit about all that. But maybe MFA members should.

You tell us.

The horses are all facing away from us–maybe they know something.

Like the MFA has it ass-backwards?